If the contrived flow of water should somehow just stop, California's economy, which was worth about a trillion dollars as the new millennium dawned, would implode like a neutron star.

—Marc Reisner, A Dangerous Place, quoted here

Insurance, the Stuff of Life

Much of first-world life and its stability revolve around insurance.

We already know the hell the under–health-insured go through. That crisis is on us now, has been for a while, and no one with power, at least in the U.S., dares to address it.

The donor class, especially the health care queens and kings, would put out the eyes of anyone with power who did, and send them to live in the wilderness — Kentucky, perhaps. Or Maine. (By those with power I don’t mean Bernie Sanders. He’s not a decider. I mean Joe Biden and those who hold the real reins in our houses of Congress.)

But more than our health depends upon good insurance. Our homes as well — the shelter that keeps us from living in forests and caves; hogans, longhouses and tipis; that which keeps most of us urban, in other words — depends on the ability to insure against destruction.

So imagine if you lived in a state in which home and property insurance was unavailable. What would you do? Most, I think, would move to another state. The rest would shelter in place, go uninsured.

Is that outcome likely? Let’s take a look.

The Day of the Uninsured

The day when whole states will go uninsured is approaching. Many pick California for its many wildfires as an early candidate, and for very good reason.

But California is big and varied, and several disasters would have to accumulate there — water shortages; massive fires, especially where rich people live, like Malibu Canyon; earthquakes; collapse of the water table; and more — before the state became uninhabitable. It will, but maybe not soon.

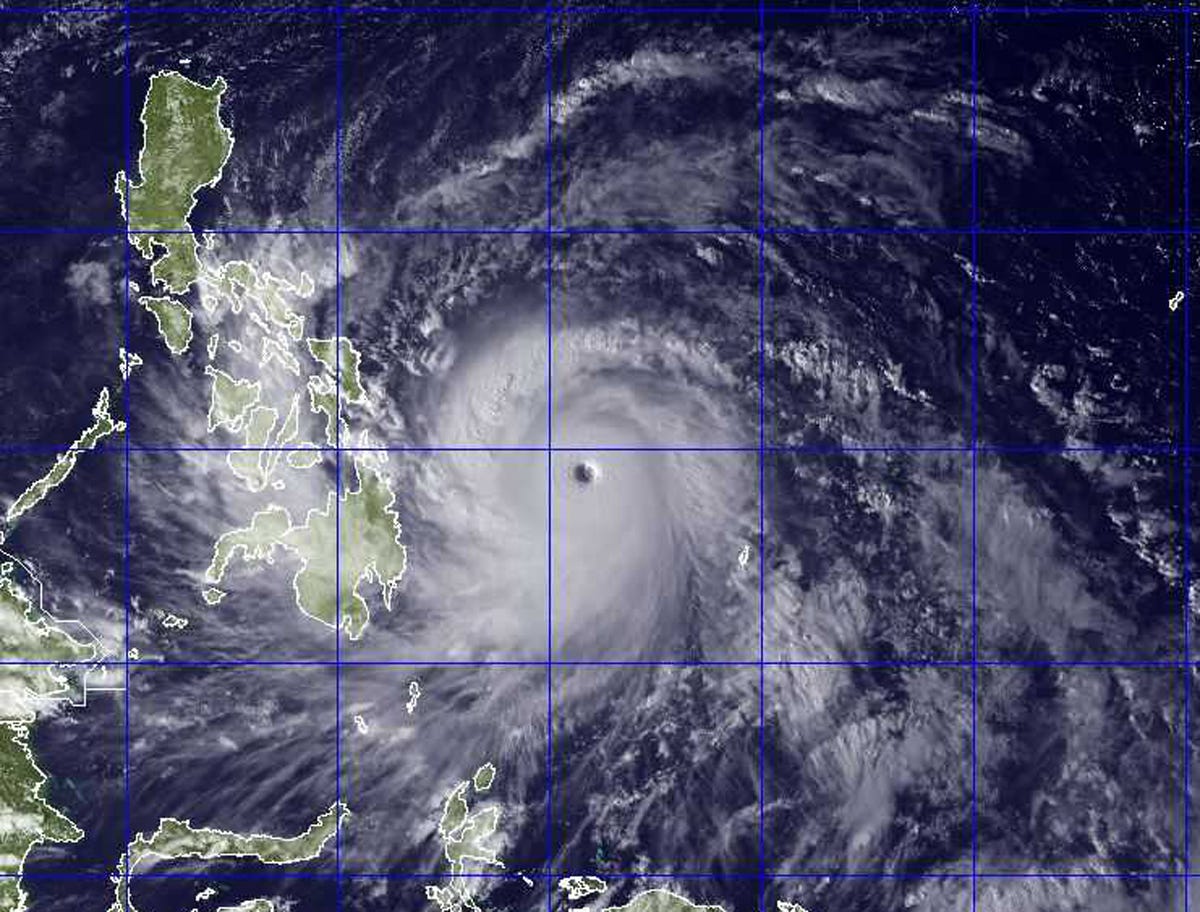

Florida is a different story. There a Typhoon Haiyan–type event could make coastal and inland real estate disappear, leaving the rest uninsurable, all in a day.

That day could be tomorrow, or any day you like. Atlantic hurricane season is June though November, but hurricanes occur outside of that window as well.

Not only does the chance of a major hurricane increase by the year, but the costs are increasing as well.

But you knew that, right? You knew that global warming is accelerating, and the odds of avoiding frequent and large-scale disasters grows slim by the year.

Insurance Costs Are Already Increasing

The cost of insuring a home or business location — indeed, a livelihood — grows naturally greater as the likelihood of disaster increases, until at some point insurance just disappears.

So, how safe are we who live in the dangerous states? Bloomberg Green took a look at the state of insurance by state:

US Home Insurance Premiums May Hit a Record This Year, Report Warns

The average premium for US homeowners insurance is expected to hit $2,522 this year, up 6% from the end of 2023. Premiums in Florida will approach $12,000.

Not a good headline. The article goes on (my emphasis):

In the 1980s, the country experienced about three disasters a year that caused damages of at least $1 billion each. In the 2010s, that climbed to 13 per year, according to the National Oceanic and Atmospheric Administration. Last year, the US endured a record 28 weather and climate disasters that caused at least $1 billion in damages each.

Responding to climate-induced threats, a growing number of insurance companies are pulling out of California and Florida, where those impacts are frequently felt. To fill the gap, state “insurers of last resort” are absorbing trillions of dollars in risk.

“It’s possible that the highest-risk areas will become uninsurable,” says Betsy Stella, vice president of carrier management and operations at Insurify.

About California, as the article notes, the exodus has already started:

State Farm General Insurance Co. will cut about 72,000 policies in California beginning in July, the latest move by the state’s biggest insurer to cope with growing risks from wildfires and other natural disasters.

The move comes just nine months after State Farm announced plans to stop issuing new coverage in the most populous US state. …

State Farm cited the company’s financial health as the reason for the cuts. Expect other insurers in other states to reach the same conclusion as disasters accumulate.

About Florida, Bloomberg states: “Homeowners in Florida, who already pay the highest rates of home insurance in the country, are expected to see another 7% increase this year — bringing the state average to $11,759, more than four times the national average.”

Anecdotally, one Florida resident I know said her homeowner’s insurance went from $3,000 to $14,000 in just six years. Where this will end should be obvious.

Not Just Florida

Seven states, none of them Florida, will see double-digit homeowner insurance rate increases.

Says Bloomberg:

For states with rising premiums, Insurify’s researchers largely point the finger at the increase in natural catastrophes. According to AccuWeather, the US can expect an “explosive” hurricane season this year, with the potential for as many as 25 named storms between June and November, compared with about 14 on average. Meanwhile, sea-level rise and other adverse climate impacts are catching up with historically low-risk states like Maine.

Something else to anticipate.

Time to Consider a Change?

The good news is this: the worst hasn’t happened yet, even in states where bad things tend to occur. There’s time to leave before everyone leaves before you, and you’re left selling to no one who wants to buy.

The bad news is obvious: for many, a world without insurance is in the cards. The numbers vary, but according to NOAA, about 40% of Americans live in coastal counties.

NOAA estimates that if U.S. coastal counties were their own country, they’d be third in world GDP. All of which will be lost, sooner or later, to sudden disaster or eventually, sea level rise. You can count on insurance companies to pull out of those areas ahead of those liabilities having occurred.

A world without insurance. Time to plan now?

Am I misunderstanding the lower graphic....there's a $ sign in front of 54.6 million employed [employed people, I assume].

I am reminded of an Alan Perlis quip about Lisp programmers, "they know the value of everything and the cost of nothing." (Lisp is the second oldest high level computer programming language next to Fortran.) Well I say this not in jest, what is a gentle admonition about abusing system resources in the context of computing machinery is an all too accurate portrayal of current human existence.

When you consider the large coastal populations of the U.S. what motivates these inhabitants is scenery, not survival, as it is in Bangladesh. Scenery, not survival motivates most decisions about home location in the U.S.

Much of the U.S. is going to be rather unpleasant to occupy with large arid areas, or high humid heatdomes everpresent, or salt water intrusion into fresh water distribution systems. The value of all these locations is realistically nothing. The cost for remedies matters not. There are simply not the resources available to ameliorate coming adverse conditions.